News & Articles

Navigating Geopolitical Uncertainty: A CFO's Guide to FX Risk Management

Navigating Geopolitical Uncertainty: A CFO's Guide to FX Risk Management

In today's volatile global landscape, Chief Financial Officers face an increasingly complex set of challenges. Among these, geopolitical risk and its impact on foreign exchange (FX) markets stand out as critical concerns for UK businesses. A recent webinar hosted by ICAEW (Institute of Chartered Accountants in England and Wales) in association with Birchstone shed light on these pressing issues, offering valuable insights for financial leaders.

The Evolving Nature of Geopolitical Risk

Geopolitical risk, once primarily associated with military conflicts and international politics, has evolved significantly over the past two decades. Today, it encompasses a broader spectrum of issues, including technological dependencies (such as the global semiconductor supply chain) and shifts in economic power dynamics. For CFOs, understanding this expanded definition is crucial, as these factors can have profound effects on currency markets and, consequently, on a company's financial health.

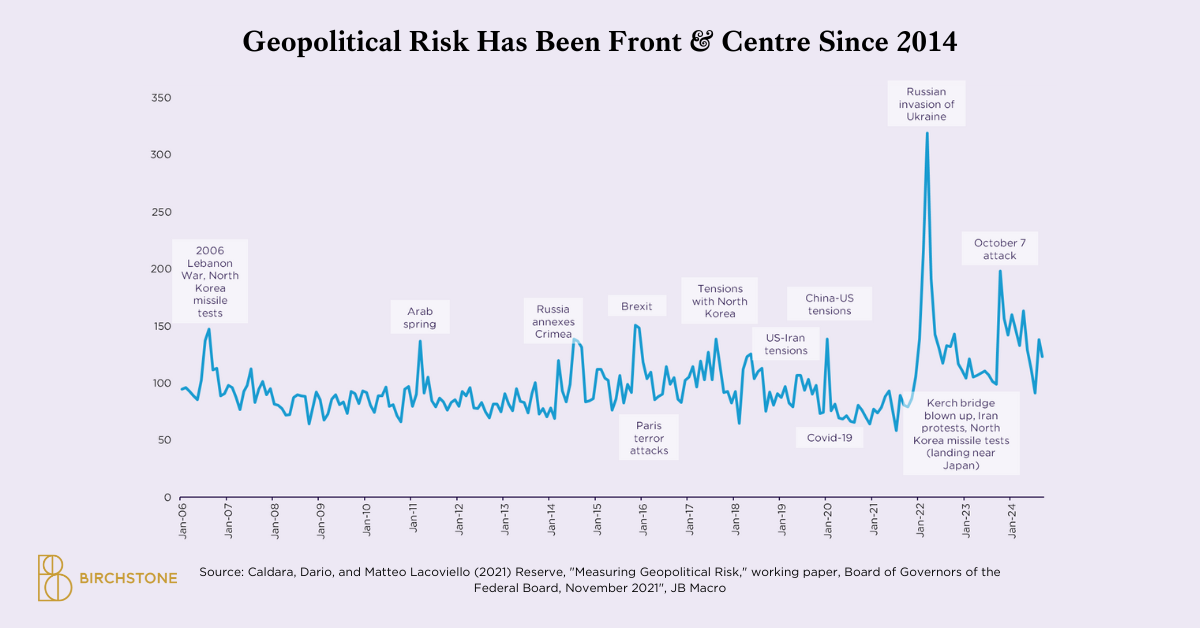

Geopolitical Risk Has Been Front & Centre Since 2014

Source: Caldara, Dario, and Matteo Lacoviello (2021), "Measuring Geopolitical Risk," working paper, Board of Governors of the Federal Reserve Board, November 2021", JB Macro

The graph illustrates the Geopolitical Risk Index from 2006 to 2024, providing a stark visual representation of global instability over the past two decades. What's immediately striking is the sharp increase in both the frequency and intensity of geopolitical events since 2014. The Russian invasion of Ukraine in 2022 stands out as the most significant spike, dwarfing previous crises. Other notable events, such as Brexit, US-China tensions, and the COVID-19 pandemic, have all contributed to a persistently elevated risk environment. For CFOs, this graph underscores the critical importance of robust FX risk management strategies. The unpredictable nature of these events, often causing rapid currency fluctuations, highlights the need for flexible, forward-looking approaches to hedging and financial planning. It's clear that geopolitical risk is no longer an occasional concern but a constant factor in the financial landscape, requiring ongoing vigilance and adaptability from financial leaders.

The Impact on Currency Markets

When geopolitical events unfold, their ripple effects are often felt most immediately in the currency markets. As Jonathan Pryor, Managing Director of Birchstone Markets, points out, "when geopolitical events occur in a country, or in close proximity, it is likely the respective currency will be adversely affected." He cites the example of Brexit in 2016, which led to a significant devaluation of the pound due to the uncertainty it created.

Moreover, geopolitical events often trigger a "flight to safety" among investors. Traditionally, this has meant a shift towards precious metals like gold, value stocks, and certain currencies - with the US dollar often being a primary beneficiary. For UK-based CFOs, this trend can present both challenges and opportunities, depending on their company's exposure to different currencies.

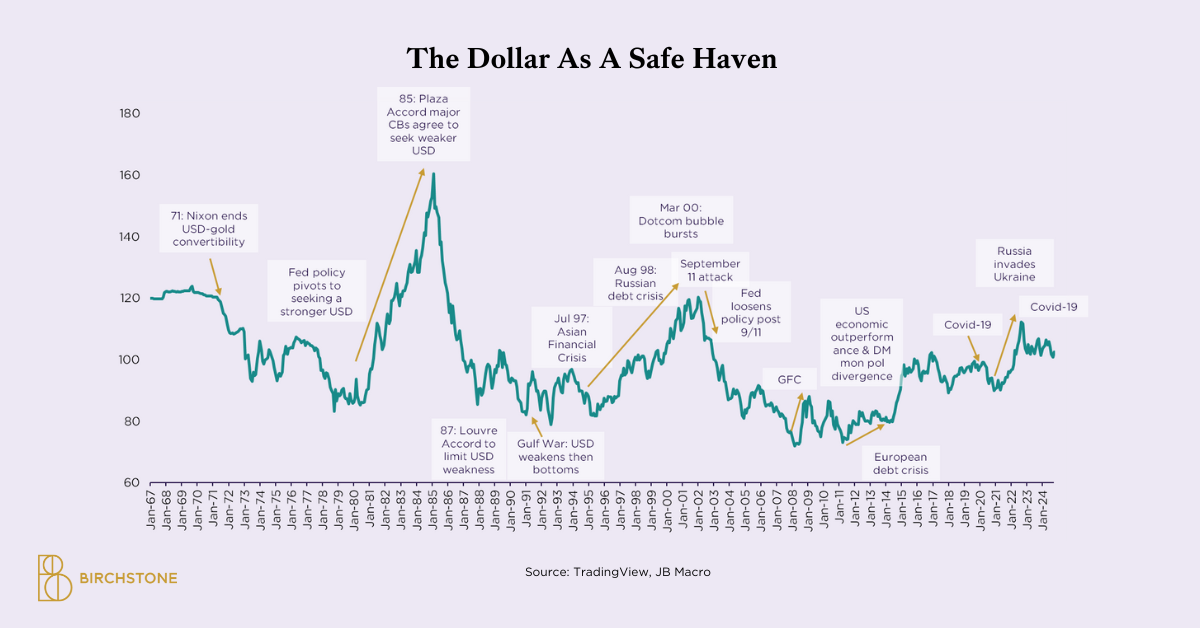

The Dollar as a Safe Haven

Source: TradingView, JB Macro

This graph illustrates the Dollar Index (DXY) from the 1970s to 2024, showcasing the U.S. dollar's role as a safe haven currency during times of global uncertainty. The chart reveals several significant spikes in the dollar's value, often coinciding with major geopolitical or economic events. Notable peaks include the Plaza Accord in 1985, the dot-com bubble burst in 2000, and the 2008 Global Financial Crisis. More recently, we see sharp increases during the COVID-19 pandemic and Russia's invasion of Ukraine in 2022. These patterns demonstrate how investors flock to the dollar during turbulent times, strengthening its value.

The graph underscores the importance of considering the dollar's safe-haven status in their FX risk management strategies. It highlights how global events can rapidly impact currency values, potentially affecting businesses with dollar-denominated costs or revenues. Understanding these historical trends can help CFOs anticipate potential currency movements and adjust their hedging strategies accordingly, especially during periods of heightened geopolitical or economic uncertainty.

Lessons from the Retail Sector

The webinar featured insights from Neil Greenhalgh, former CFO of JD Sports, offering a practical perspective on managing FX risk in a global retail business. The sports industry, with its reliance on Asian manufacturing and US dollar transactions, serves as an excellent case study for CFOs across sectors.

Greenhalgh highlighted two types of FX risk:

1. Indirect Risk: This accounts for over 90% of product purchases in his experience. International brands invoice retailers in local currencies, but their pricing reflects their own FX positions. Thus, even when paying in pounds, UK retailers still face FX risk that impacts product margins.

2. Direct Risk: This involves direct contracts with factories, typically paid in US dollars. While representing a smaller portion of purchases (less than 10% in JD Sports' case), it still amounted to significant sums - around $400 million annually for JD Sports.

A Strategic Approach to FX Risk Management

Greenhalgh outlined a pragmatic approach to FX risk management that CFOs across industries can learn from:

1. Long-term Planning: In the retail sector, orders are typically placed up to 12 months in advance. This necessitates a forward-looking approach to FX risk management, considering potential currency movements over an extended period.

2. Seasonal Strategy: Align your FX hedging strategy with your business cycles. For retailers, this might mean Spring/Summer and Autumn/Winter seasons.

3. Standard Rate Setting: Establish a prudent "standard rate" for each season or business cycle, agreed upon with relevant teams (e.g., procurement) well in advance.

4. Progressive Cover Building: Gradually build up FX cover over time, rather than making large, one-off hedges. This approach helps smooth out short-term volatility and takes advantage of favorable movements.

5. Diversified Hedging Instruments: Use a mix of financial instruments. Vanilla forwards provide certainty, while more complex trades can offer upside potential if currency movements are favorable.

6. Balanced Coverage: Aim for substantial but not complete coverage. Greenhalgh suggests hedging 80-90% of predicted requirements, leaving some flexibility for spot market purchases.

The Importance of a Measured Response

One key takeaway from Greenhalgh's experience is the importance of a measured, long-term approach. By building cover progressively over an extended period, CFOs can avoid overreacting to short-term news or events that may be either positive or negative for their base currency.

This strategy allows for a more stable and predictable financial position, crucial for effective business planning and stakeholder communication.

Broader Implications for UK CFOs

While the retail sector provides valuable lessons, the principles of effective FX risk management apply across industries. UK CFOs should consider:

1. Industry-Specific Exposure: Evaluate your sector's unique exposure to geopolitical and FX risks. Which currencies are most critical to your operations?

2. Supply Chain Analysis: Assess both direct and indirect FX risks in your supply chain. Even if you're not directly transacting in foreign currencies, your suppliers likely are, which can impact your costs.

3. Revenue Streams: For companies with international sales, consider how currency fluctuations might affect your revenue when converted back to pounds.

4. Technological Tools: Leverage modern financial technologies to monitor currency movements and manage hedging strategies more effectively.

5. Scenario Planning: Develop and regularly update scenarios for major geopolitical events that could impact your business and plan your FX strategy accordingly.

6. Board Communication: Ensure your board understands your FX risk management strategy and its rationale. Regular updates on this aspect of financial management are increasingly crucial in today's volatile environment.

7. Continuous Education: Stay informed about global geopolitical trends and their potential impacts on currency markets. This knowledge is now a core competency for effective financial leadership.

As geopolitical risks continue to evolve and impact global markets, UK CFOs must adapt their approach to FX risk management. The experiences shared in the ICAW webinar underscore the need for a strategic, long-term view combined with the flexibility to react to significant events.

By adopting a measured approach to hedging, aligning FX strategy with business cycles, and maintaining a keen awareness of global events, CFOs can navigate the choppy waters of international finance more effectively. In doing so, they not only protect their companies from adverse currency movements but also position them to take advantage of favorable shifts in the global economic landscape.

In an era where geopolitical events can send shockwaves through currency markets in a matter of hours, robust FX risk management is no longer just a financial imperative – it's a strategic necessity for UK businesses operating in a global context.

To watch a recorded session of the webinar please click here.

Birchstone Markets Limited is registered as a Limited Company in England. Companies House No. 13146432. Registered Office: 103 Wigmore Street, London, W1U 1QS. Birchstone Markets is an Agent of Hamilton Court Foreign Exchange Limited, which is registered with the Financial Conduct Authority under the Payment Services Regulations 2017 (FRN 810625) for the provision of payment services. Birchstone Markets is an Authorised Representative of Hamilton Court Foreign Exchange Limited, which is Authorised and Regulated by the Financial Conduct Authority (FRN 810631) to deal in certain Investment services. Birchstone Markets is registered with the Information Commissioners office under the 2018 Data Protection Act and GDPR (Registration Number ZB147227).